The Disclosure Opportunity

An assessment of the first tranche of mandatory Climate-Related Disclosures: How are we stacking up?

In 2021 New Zealand’s Parliament mandated climate-related financial disclosures for climate reporting entities which include around 200 large financial institutions including publicly listed companies, large insurers, banks, and investment managers. Regime requirements include the need to disclose GHG emissions, climate governance, risks and opportunities to be captured in climate statements.

With over 60% of the world’s GDP now subject to mandatory climate-related disclosures, this level of transparency is only set to increase in coming years. This increased transparency is positive and will benefit investors increasingly looking for climate friendly investments.

While overall positive, the pace of change is significant for Directors and presents a steep learning curve given the need for increased granularity in data, enhanced metrics for performance measurement, forecasting, and equal weighting of financial and non-financial assessment.

For New Zealand to fully leverage being first out of the gate on climate related disclosures, Directors now have a strategic opportunity to advance business model innovation and resilience.

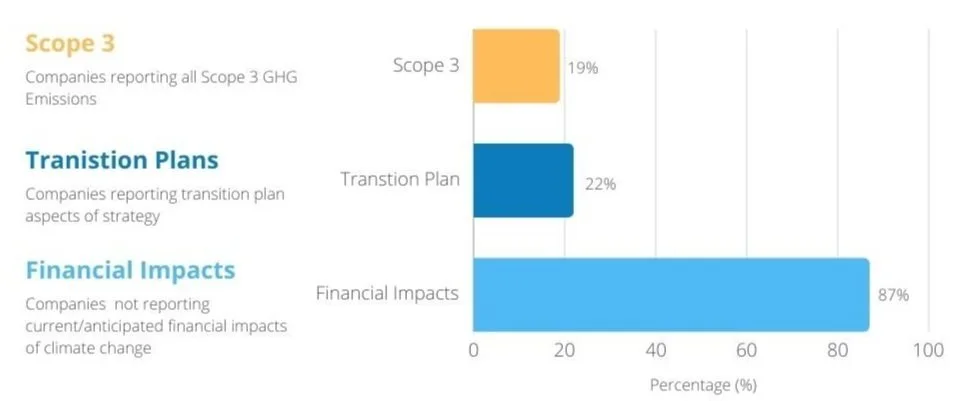

Our assessment of the performance of the first tranche of climate statements published for the Y1 reporting period against the adoption provisions has revealed:

87% of companies have not reported either current or anticipated financial impacts of climate change.

22% of companies reported the transition plan aspects of their strategy, including how their business model and strategy might change to address its climate-related risks and opportunities. Given that Transition Plans are a vital tool for investors and wider stakeholders to assess commitment and ability for the business model to remain relevant in a net zero carbon economy, many will be looking forward to seeing disclosures in this space in the next reporting period,

Only 19% of companies chose to report all of their Scope 3 greenhouse gas emissions. With disclosure requirements widening in Y2, Directors will need to be aware of the need to actively advance the measurement of Scope 3 emissions.

Detailed Analysis & Insights

Current and Future Financial Impacts

Financial impact disclosures are critical to an investor’s understanding of not only how the company is managing climate risks and opportunities, but also how climate change may impact its business model and financial performance and prospects.

In total 97% of companies took advantage of the exemption provisions and chose not to report future financial impacts of climate change. Specifically, 13% of tranche 1 climate statements assessment reported on current financial impacts and 3% reported on anticipated impacts.Transition Planning

22% of tranche 1 climate statements reported on Transition Planning with the remaining 78% choosing to take advantage of Y1 exemption in this area.

This requirement sets an expectation to disclose the role the reporting company will play in reducing the level of climate-related risks facing present and future generations. This includes demonstrating how the transition toward a low-emissions, climate-resilient future is consistent with the core business model and strategy, and that aspirations are backed up by concrete actions.

Given Y2 requirements include disclosures on how transition plans are backed by clear linkages to capital deployment and funding decision-making processes significant uplift will be required by companies in this area.

Scope 3 GHG Emissions Reporting

Carbon measurement supports the assessment of GHG exposure and risk from GHG emissions across the value chain. Scope 3 GHG emissions are generally the largest source of emissions and present the most significant opportunities for reductions.

While provision 4 provides an exemption from reporting Scope 3 GHG emissions in its first reporting period 19% of entities chose to report all of Scope 3 emissions.

If not already underway, organisations should start measuring their Scope 3 GHG emissions immediately. It’s important to note that XRB standard on assurance over GHG emissions disclosures in CRDs applies to annual reporting periods that end on or after 27 October 2024. Essentially, reporting entities must ensure that the parts of their climate statements relating to GHGs are independently assured.

The assurance standard sets out requirements concerning ethics, independence, competence, using the work of others, management bias, fraud, non-compliance with laws and regulations, comparative information, independent assurance, documentation and quality management. This is a key aspect of reporting requirements that entities need to be across.

Book assurance assessment early

As the assurance standard at the time of writing is in draft form, keep abreast of developing changes via the XRB website

Uncharted territory: Support for climate reporting entities

Y2 provisions are a step up and are unchartered territory for most Directors.

There are a number of ways The Lever Room is supporting entities on their climate reporting journey. We are experienced in all facets of the NZ CRD statement process from board dialogues to climate scenario workshops to GHG inventories.

We’re aware that companies are currently working hard to ensure reputational, financial and legal risks are minimized through an in-depth understanding of reporting requirements as they continue to evolve. We have the experience to support in both the mandatory space, and more widely across the sustainability and climate impact agenda. Climate and sustainability are also increasingly the subject of border levies, market expectations and advancing global standards.